Serious organised crime has devastating effects: exploiting the vulnerable, destabilising communities, and corroding economies. The scale is vast, but the financial flows that enable it remain fragmented and obscured, and each bank holds only part of the puzzle. Criminals exploit these gaps, shifting illicit funds across institutions and borders faster than any single entity can track.

Until now, no legal or technical framework existed to combine customer-level data across banks, leaving law enforcement and financial institutions hamstrung in their fight against illicit finance. Recognising this challenge, NatWest Group co-designed and co-led the Data Fusion pilot, a world-first partnership that fused multi-bank data, aligned risk indicators, and built a joint analytical capability with the National Crime Agency (NCA).

“This is a very complex data challenge delivering tangible results… It is a brilliant initiative, and I particularly like the collaborative element.” – Judges’ comments

Building a Shared Capability

The initiative began with a simple but ambitious question: what does serious and organised crime look like in our data? Through workshops involving investigators, analysts, engineers, and risk specialists from across participating banks and the NCA, three high-harm typologies were prioritised:

- Cash-based money laundering.

- Modern slavery and human trafficking.

- Organised immigration crime and forced labour.

These were chosen for their social harm and because they left detectable traces in financial data. Working together, participants co-developed nearly 90 threat indicators, each tested for legal feasibility and proportionality.

A common data schema was then painstakingly designed, enabling institutions with vastly different systems to produce compatible datasets. For the first time, banks could securely run their data against a shared indicator set, upload encrypted outputs, and create a unified, cross-institutional view.

From Pilot to Impact

The Joint Analytical Team, comprising experts from banks and the NCA, ran agile sprints to interrogate the fused data. In just months, the pilot delivered:

- 100+ intelligence packages to law enforcement.

- 100+ disseminations to banks.

- Eight previously unknown organised crime groups identified.

- Ten of the NCA’s top cases enhanced with new leads.

The intelligence has triggered new investigations, accelerated existing ones, and led to victims being safeguarded. By surfacing networks invisible to any single organisation, Data Fusion has materially reduced criminals’ ability to operate.

A Responsible Model

From the outset, Data Fusion was designed with robust governance and privacy safeguards. A full Privacy Impact Assessment was completed, a formal Data Sharing Agreement signed, and oversight embedded at every stage. Data was only shared when multiple indicators of serious crime were met, ensuring ethical, proportionate use.

The judges agreed that this is a model that exemplified responsible, ethical, privacy-conscious data sharing. Furthermore, the success of Data Fusion is already multiplying. Insights are being shared with the wider financial sector and regulators, refreshing risk indicators and enabling broader prevention. Real-time capabilities are now in scope, and international interest suggests global applicability.

The judges commended NatWest Group and its partners for proving that data, when shared securely and responsibly, can prevent crime and protect lives. By dismantling silos and creating a model for collaborative analytics, NatWest has not only disrupted criminal networks but shown the financial industry what’s possible when data serves society.

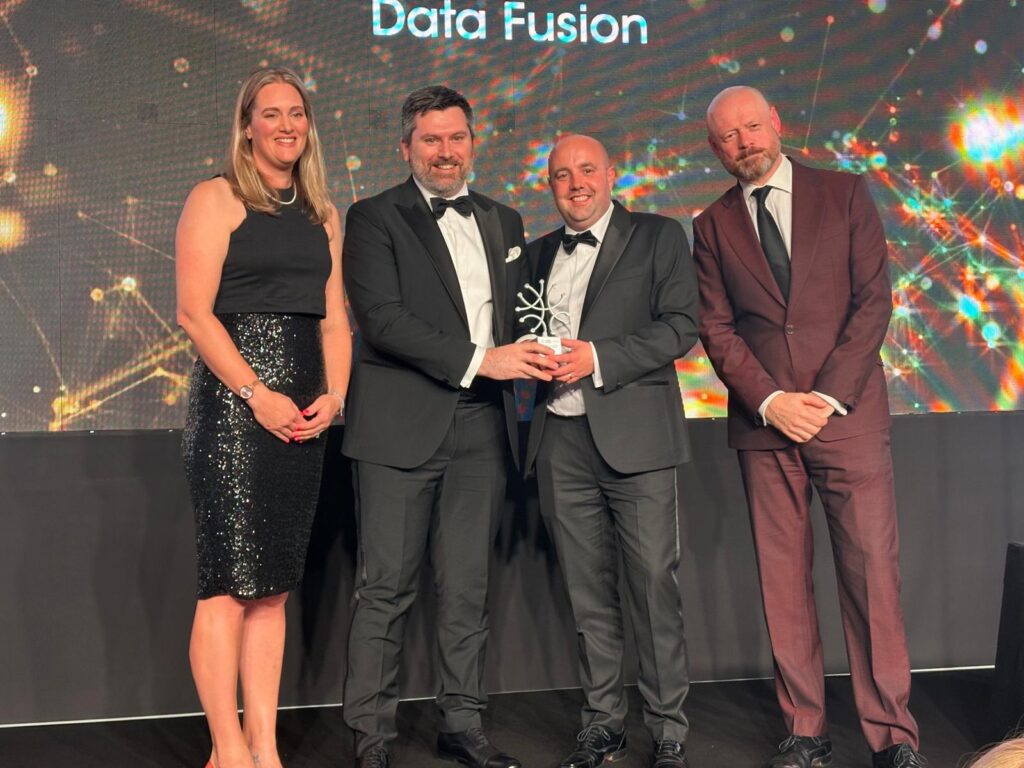

For this pioneering work, NatWest Group’s Digital X Data & Analytics team is the 2025 winner of the Data & AI for Good Hero Organisation Award.